For decades, the memory world has been a two-party system: DRAM for speed, NAND flash for storage. Together, they’ve powered everything from your smartphone to the world’s largest data centers. But now, an upstart challenger is threatening to collapse the hierarchy and rewrite the rules: UltraRAM.

Born from research at Lancaster University and commercialized by Quinas Technology in partnership with wafer giant IQE, UltraRAM promises to merge the speed of DRAM with the persistence of NAND into one “universal memory.” If successful, it won’t just compete; it could replace both incumbents outright.

The Weapon: Quantum Trickery

UltraRAM’s magic lies in a triple-barrier resonant tunnelling (TBRT) structure, built from exotic semiconductors like GaSb, InAs, and AlSb. Instead of brute-force transistor tricks, it uses quantum mechanics: electrons tunnel through barriers with almost no energy loss, flipping states in under 100 nanoseconds while sipping less than one femtojoule per switch.

- Speed: DRAM-level fast

- Persistence: Data survives power loss, like NAND

- Durability: Up to 4,000× tougher than NAND flash

- Efficiency: Far lower power than both DRAM and NAND

- Longevity: Data retention up to 1,000 years

It’s like someone handed DRAM a shield, NAND a jetpack, and told them to fuse.

The Rivalry Heats Up

For decades, Samsung, Micron, SK hynix, Kioxia, and SanDisk have run the DRAM and NAND duopoly like a closed club. They control fabs, supply chains, and pricing power. UltraRAM threatens to blow up this comfortable balance.

But to do that, it must do the impossible:

- Crash the supply chain party: Device makers and OS vendors would need to support UltraRAM instead of the entrenched DRAM + NAND combo.

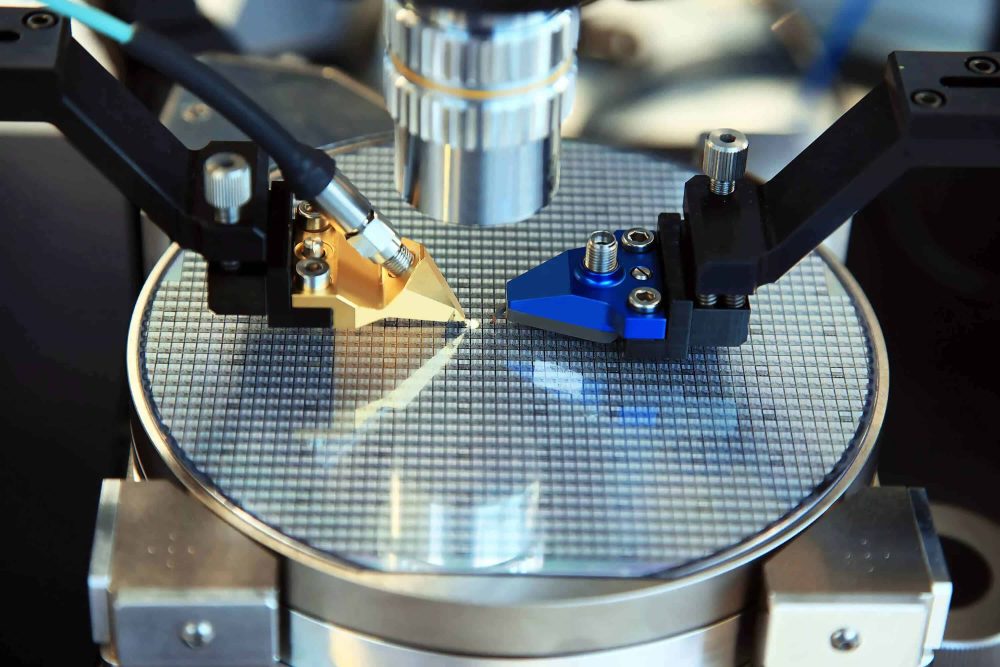

- Scale epitaxy to industry levels: Quinas and IQE’s gallium antimonide/aluminum antimonide epitaxy is groundbreaking, but yield and cost control will decide its fate.

- Prove profitability: Innovation doesn’t matter if fabs can’t produce chips at volume margins that compete with the DRAM–NAND giants.

The incumbents aren’t likely to roll over. Expect DRAM and NAND vendors to either dismiss UltraRAM as a lab curiosity — or quietly plot their own counterattacks, whether through MRAM, ReRAM, or advanced 3D NAND.

What If

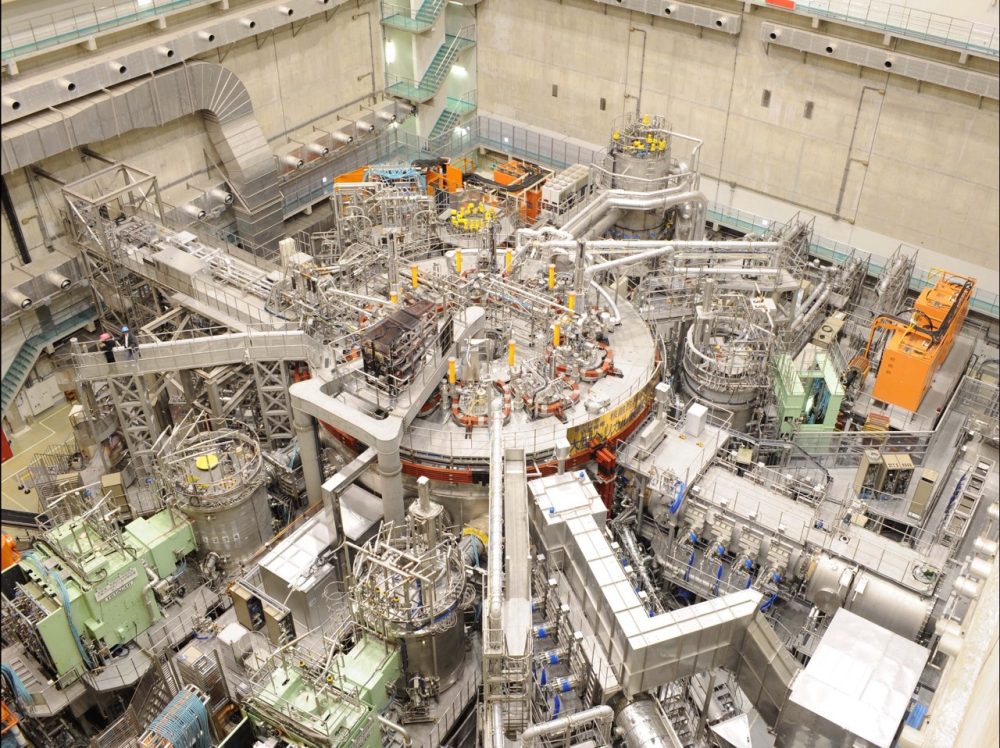

If UltraRAM succeeds, the memory hierarchy collapses. No more juggling volatile vs. non-volatile tradeoffs. Systems from AI accelerators to quantum computers, from defense satellites to your next smartphone, could all run faster, cooler, and longer. Data centers, where DRAM refresh power costs millions, could save a fortune.

But if UltraRAM fails to scale, it risks being remembered as just another “universal memory” dream that died in the fab.

The Endgame

UltraRAM’s story is shaping up to be the Rocky vs. Apollo Creed of storage tech. On one side: the entrenched giants of DRAM and NAND, armed with decades of scale and market dominance. On the other hand, a scrappy quantum-tunnelling newcomer, with a design so radical it could rewrite the architecture of digital technology.

The fight is only beginning. And if UltraRAM lands its punches, the memory establishment may never recover.