In 2005, Intel’s then-CEO, Paul Otellini, envisioned a bold future. He suggested that Intel acquire Nvidia—a relatively small player in computer graphics at the time—for a jaw-dropping $20 billion, a considerable amount by the day’s standards. Yet, Intel’s board resisted, deeming it too costly and risky. Today, Nvidia is worth over $3.6 trillion, leaving Intel’s former decision-makers grappling with one of the largest “what if“ scenarios in tech history. But what if Intel had seized the opportunity? How would the tech landscape look now?

The Reality of the Missed Opportunity

To Intel, an Nvidia acquisition would have opened doors to cutting-edge graphics and artificial intelligence technologies before they became global disruptors. Intel’s leadership saw Nvidia’s potential, anticipating that its chip designs might redefine data centers—a prescient vision in the age of AI and cloud computing. But at that pivotal moment, Otellini retreated, unable to convince the board that Nvidia’s GPU technology could someday transcend mere graphics.

Instead, Intel placed its bet on Larrabee, an internal project to build hybrid CPU-GPU chips based on Intel’s x86 technology. The effort, helmed by current CEO Pat Gelsinger, was ahead of its time but failed to deliver the performance needed for a competitive GPU product, forcing Intel to retreat from the graphics space. Today, Intel remains a distant competitor to Nvidia, struggling to carve out a niche in AI chips with products like the Gaudi 3 AI accelerator, positioned as a lower-cost alternative to Nvidia’s industry-leading offerings.

What If Intel Had Bought Nvidia? A Parallel Universe

Imagine if Intel had acquired Nvidia in 2005. The combined force of Intel’s manufacturing power and Nvidia’s pioneering GPU designs could have created an unstoppable juggernaut in AI, cloud computing, and gaming. By the late 2000s, Nvidia’s advancements in GPU technology—boosted by Intel’s financial clout and engineering resources—would have established Intel as a major player in the burgeoning world of AI and high-performance computing. Here’s what could have changed:

Intel Dominates AI

Instead of Nvidia, Intel would lead today’s AI revolution, supplying essential hardware for data centers and AI-driven applications. Imagine an Intel where every data center uses AI accelerators, from Google’s data centers to Tesla’s self-driving technology. With Nvidia’s innovative CUDA platform under its wing, Intel could have taken an early lead in AI software development, luring researchers and developers into its ecosystem.

Redefined Gaming Industry

Nvidia’s GPUs drove the gaming industry to new heights. If Intel had gained control, it might have been at the forefront of gaming advancements, delivering cutting-edge graphics for PCs, consoles, and cloud gaming. Rather than AMD or Sony, Intel could be responsible for the visual fidelity we see in today’s AAA games. Intel could be central to powering platforms like Sony PlayStation or Microsoft Xbox.

AI Hardware Monopoly

If Intel had Nvidia’s CUDA, they would have effectively locked down AI software development within their ecosystem. Google, Amazon, and countless AI startups would have developed applications exclusively on Intel’s CUDA-based platform, leaving competitors like AMD scrambling to catch up.

A Possible Nvidia-Less World

Intel’s Larrabee project likely would have taken a different path. Nvidia’s technology would have bolstered Intel’s graphics division, making AMD’s Radeon GPUs the sole GPU competition. The market might have been starkly polarized, with Intel-Nvidia controlling everything from gaming GPUs to AI accelerators, leaving AMD in a much weaker competitive position.

Intel’s Culture: The Achilles’ Heel of Missed Opportunities?

Intel’s board balked at the acquisition cost and integration challenges, emblematic of a corporate culture that former executives have described as risk-averse. At the time, Intel executives likened the company to a “single-cell organism,“ focused almost exclusively on x86 processor dominance. This mentality may have hindered Intel’s vision in emerging sectors, as seen with Nvidia in 2005 and later with missed AI investments in OpenAI.

The Fallout: Intel’s Position in Today’s Tech World

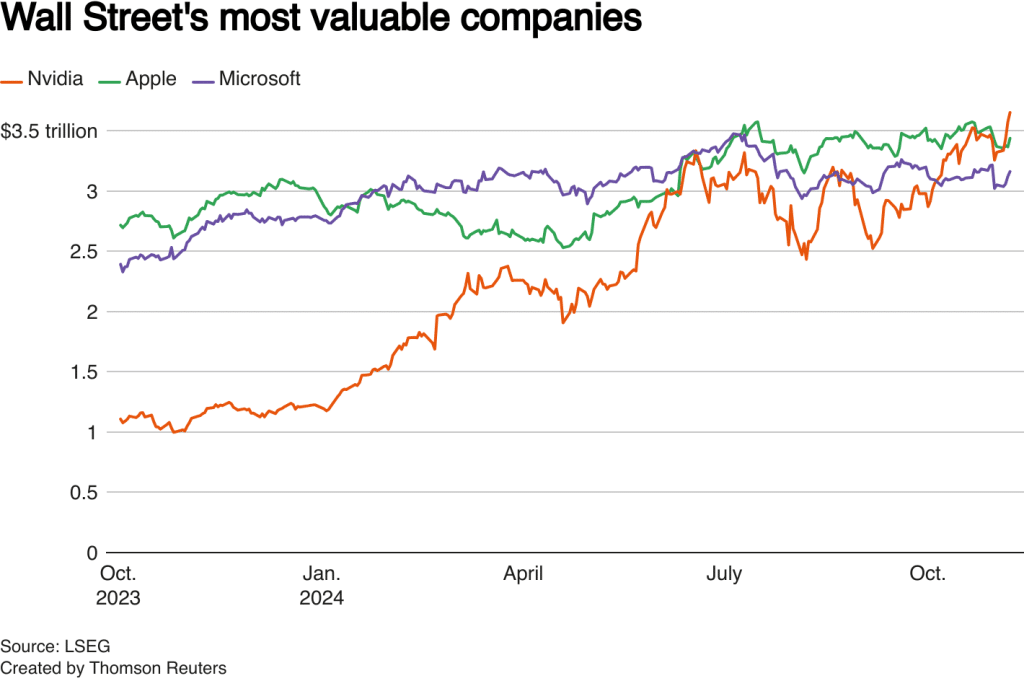

Instead of a diversified portfolio, Intel now finds itself reeling in the face of Nvidia’s AI monopoly and the dominance of ARM-based chips in mobile devices. Today, Intel’s market cap languishes under $100 billion—a fraction of Nvidia’s $3.5 trillion. The absence of Nvidia’s transformative GPUs leaves Intel struggling to remain relevant and forced to compete in a market it could have controlled.

What This Means for Users Today

For today’s tech users, Intel’s missed acquisition of Nvidia shapes nearly every interaction with AI, graphics, and data. Nvidia GPUs power almost every central AI platform, enabling everything from intelligent assistants to advanced medical diagnostics. Had Intel acquired Nvidia, AI technology might have reached consumers sooner, with Intel’s manufacturing allowing faster, cheaper chip production. The world missed a potentially fierce innovation race between Intel-Nvidia and AMD, potentially fostering even more rapid tech advancements across AI, gaming, and beyond.

The moral of the story? Tech’s most immense fortunes are often built on bold risks. Intel’s decision not to acquire Nvidia in 2005 remains a poignant reminder of what happens when companies fail to recognize tomorrow’s tech giants while they’re still within reach.