NVIDIA didn’t just stumble into AI leadership. Its GPUs, CUDA software ecosystem, networking stack, and developer tools became deeply embedded in AI workloads long before generative AI went mainstream. That early positioning helped turn the company into the backbone of modern data centers, and into the world’s most valuable semiconductor company.

Google has been designing AI chips for more than a decade. Its Tensor Processing Units (TPUs), originally built for internal workloads like search and image recognition, have matured into a serious alternative to GPU-based AI compute. Since 2018, Google has offered TPUs to cloud customers, and recent reports suggest the company may now be preparing to sell its AI processors directly to third parties, including Meta.

TPU VS GPU: Not Just A Performance Debate

NVIDIA still relies heavily on external foundries and packaging capacity, while Google designs its own silicon and integrates it tightly with its software, cloud platform, and AI models. While Google faces its own manufacturing constraints, its ASIC-based approach allows it to optimize for specific AI workloads in ways general-purpose GPUs cannot.

When it comes to custom AI accelerators, many industry observers already consider Google’s TPUs among the most competitive silicon in production today.

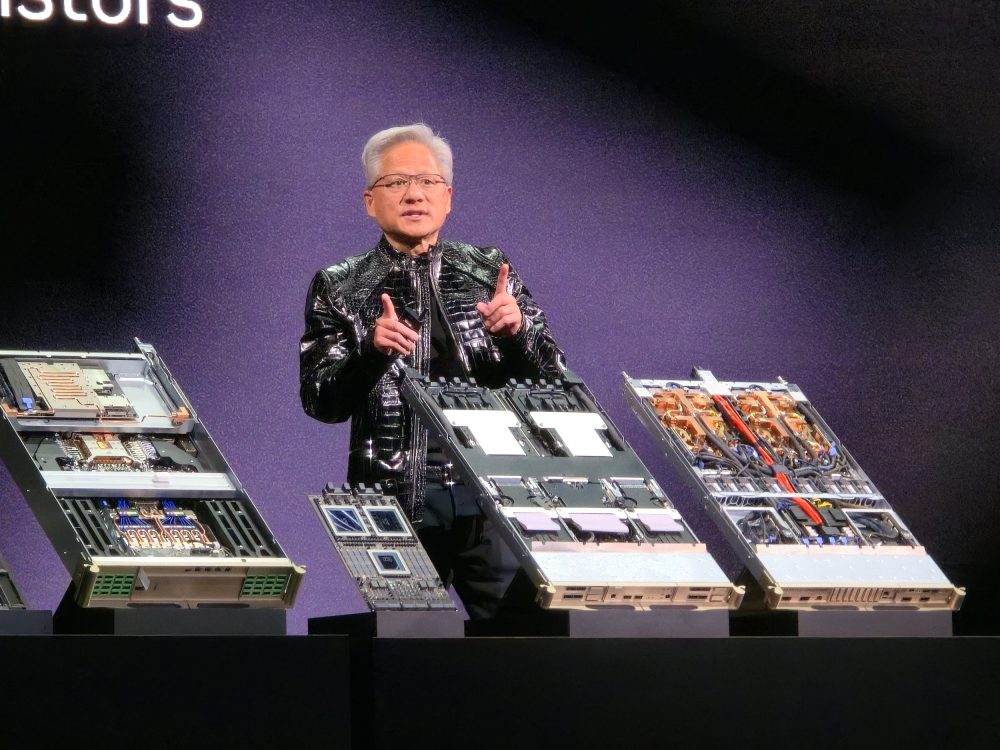

Fear, Not Optimism, Drives Jensen Huang

One of the more striking claims from Witt’s book is that NVIDIA CEO Jensen Huang isn’t driven by optimism, but by fear.

“Fear of failure, guilt, even shame are what make Jensen get up in the morning and work so hard.”

That mindset, according to Witt, explains why NVIDIA aggressively invests across every phase of AI development, from training to inference, from networking to software. It’s also why the company has managed to stay ahead despite relentless pressure from rivals.

The Competition Is Finally Real

Unlike earlier threats, Google is uniquely positioned to challenge NVIDIA:

- Deep pockets: Alphabet generated over $100 billion in net income last year.

- Cloud reach: Google Cloud is one of the few hyperscalers still gaining market share.

- Vertical integration: Google owns the silicon, the models, the software, and the distribution.

The reported interest from Meta in Google’s AI processors is particularly telling. It signals that hyperscalers and AI operators are no longer willing to accept NVIDIA as the only viable option, even if NVIDIA remains the best overall solution today.

NVIDIA Isn’t Doomed, But The Pedestal Is Cracking

To be clear, NVIDIA is not about to collapse. The AI semiconductor market is projected to grow nearly 30% annually through the next decade, and there will be room for multiple winners.

But NVIDIA’s valuation assumes near-total dominance with no credible rivals. Google’s progress challenges that assumption.

The real risk isn’t that Google dethrones NVIDIA overnight, it’s that customers start seriously considering alternatives. Once that happens, pricing power weakens, margins come under pressure, and the narrative changes fast.

For a company priced like a flawless monopoly, that’s the last thing investors want to see.