Intel continues to face setbacks following disappointing financial results, layoffs affecting 15% of its workforce, and cost-cutting measures, including potentially selling its FPGA unit Altera and halting a $32 billion German fab project. Now, reports indicate Intel’s advanced nodes, particularly 18A and 20A, are encountering issues.

In a surprising announcement, Intel revealed it would not use its own ‘Intel 20A’ process for upcoming Arrow Lake consumer processors. Instead, Intel will rely on external foundries, likely TSMC, to manufacture all Arrow Lake chip components. Intel’s role will be limited to packaging these externally produced chips. CFO Dave Zinsner, at the Citi Global TMT Conference, stated that skipping the 20A node would save Intel approximately $500 million in capital expenditures.

This decision follows Intel’s ongoing restructuring efforts after a problematic financial quarter, during which the company laid off 15,000 employees, one of the most significant reductions in its history.

Intel’s Move Away from the 20A Node

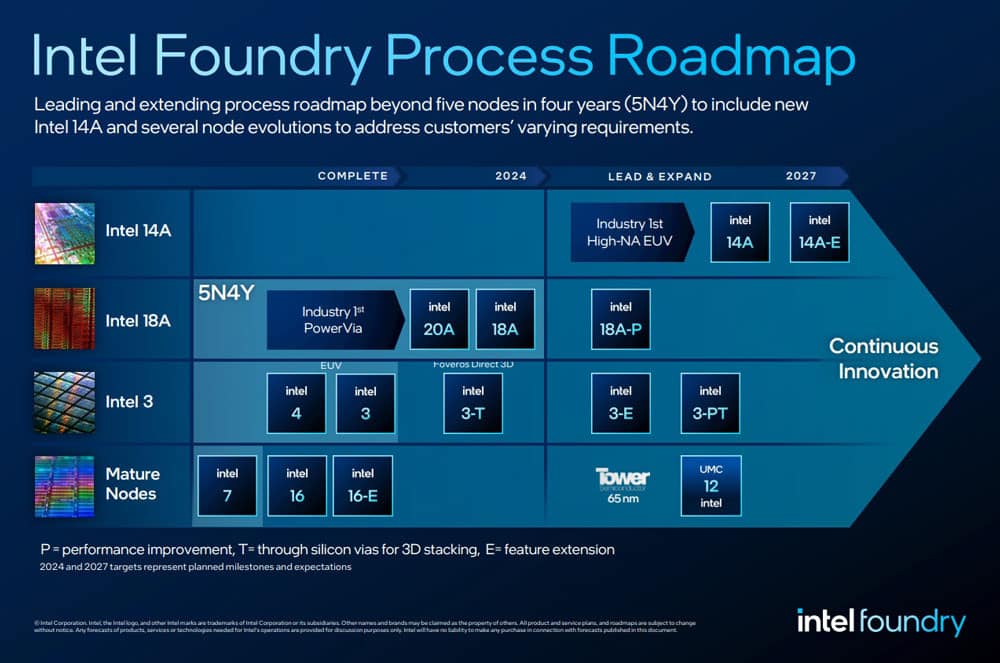

Earlier this year, Intel showcased Arrow Lake processors using the 20A node at its Innovation 2023 event. Initially planned for a 2024 release, Arrow Lake will now skip the 20A process altogether. This decision, driven by cost concerns and Intel’s aggressive timeline to develop five nodes in four years, allows the company to focus on the more advanced 18A node.

Despite canceling 20A production for Arrow Lake, Intel emphasizes that the technological advancements made with 20A—like the RibbonFet transistor and PowerVia backside power delivery—laid the groundwork for the success of the 18A node. The company has powered on 18A chips in its labs and delivered the crucial Process Design Kit (PDK) 1.0 to external customers.

Broadcom’s Concerns with 18A

However, recent reports indicate challenges with the 18A process. Broadcom tested Intel’s 18A wafers and expressed disappointment, citing concerns that the process is not yet ready for high-volume production. Broadcom’s evaluation is ongoing, and further results are expected. Meanwhile, Intel remains optimistic, with defect densities below 0.4 D0 considered a positive sign for mass production readiness.

Focus on the Future

Despite the setbacks, Intel has secured significant clients like Microsoft and the U.S. Department of Defense for its 18A node. The company aims to begin mass production by 2025 and is working to expand its foundry services to more external customers.

Intel’s 20A node served as an essential testbed for advanced techniques, but the company’s shift to 18A reflects its broader strategy to stay competitive in the semiconductor industry while managing costs. The next few months will be crucial for Intel as it seeks to demonstrate the viability of its 18A node and win over more Foundry customers.