The global semiconductor industry is entering its biggest investment wave ever, fueled by artificial intelligence. According to SEMI, sales of chip manufacturing equipment will rise for three straight years and hit a record $156 billion in 2027, marking a shift from traditional consumer cycles to an AI-driven “Giga Cycle.”

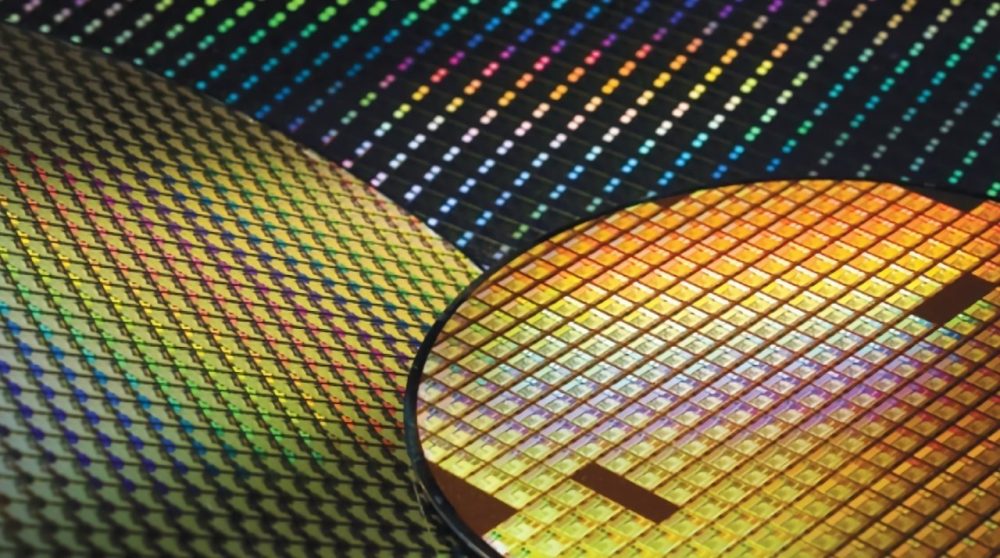

Spending is already accelerating. Equipment sales are expected to reach $133 billion in 2025, climb to $145 billion in 2026, and peak in 2027. Most of that money is going into wafer fab equipment, which is forecast to hit $116 billion in 2025, driven by demand for advanced logic chips and high-bandwidth memory (HBM) used in AI data centers. By 2027, wafer fab tools alone could reach $135 billion as manufacturers ramp up capacity for cutting-edge 2nm processes.

AI is also reshaping the broader chip market. WSTS now expects the global semiconductor industry to grow to $772 billion in 2025, with logic up 37% and memory up 28%, and to approach $1 trillion by 2026. But growth is uneven: AI-related chips are booming, while automotive and industrial segments remain weak.

China, Taiwan, and Korea will remain the biggest equipment spenders through 2027, but China’s investment is expected to decline after 2026 due to saturated mature-node capacity and limited access to EUV tools. Meanwhile, spending in the U.S. and Southeast Asia is rising fast, supported by government incentives like the CHIPS Act.

Analysts warn that 2027 could be a turning point. Today’s spending assumes AI software and services will generate massive returns, but estimates suggest the AI sector may need $2 trillion in annual revenue by 2030 to justify current infrastructure investment. If productivity gains fall short, the industry could face a sharp correction.

The boom is also running into real-world limits. AI data centers could require an extra 200 gigawatts of power by 2030, while the U.S. semiconductor industry alone may face a shortage of up to 146,000 workers by 2029.

TSMC sits at the center of this surge. As the primary manufacturing partner for AI leaders like Nvidia and AMD, the company is seeing extremely high utilization at 3nm, 4nm, and 5nm nodes. To keep up, TSMC is expected to spend as much as $50 billion on capital expenditure in 2026, expanding both advanced nodes and packaging capacity. But labor shortages and packaging bottlenecks are becoming serious challenges, highlighting the strain of operating in a near-monopolized market. AI is driving the largest capital expansion the semiconductor industry has ever seen, but the real test will come when revenue, power, and talent need to catch up with ambition.