Chinese AI chipmaker Biren Technology has kicked off bookbuilding for a Hong Kong initial public offering, aiming to raise up to HK$4.85 billion (US$624 million) as domestic GPU startups race to challenge Nvidia’s dominance in AI computing.

Based in Shanghai, Biren is offering around 247.7 million shares priced between HK$17 and HK$19.60. Trading is expected to begin on January 2, making Biren the first new Hong Kong listing of 2026 and the first mainland GPU developer to go public in the city.

Betting On AI Demand

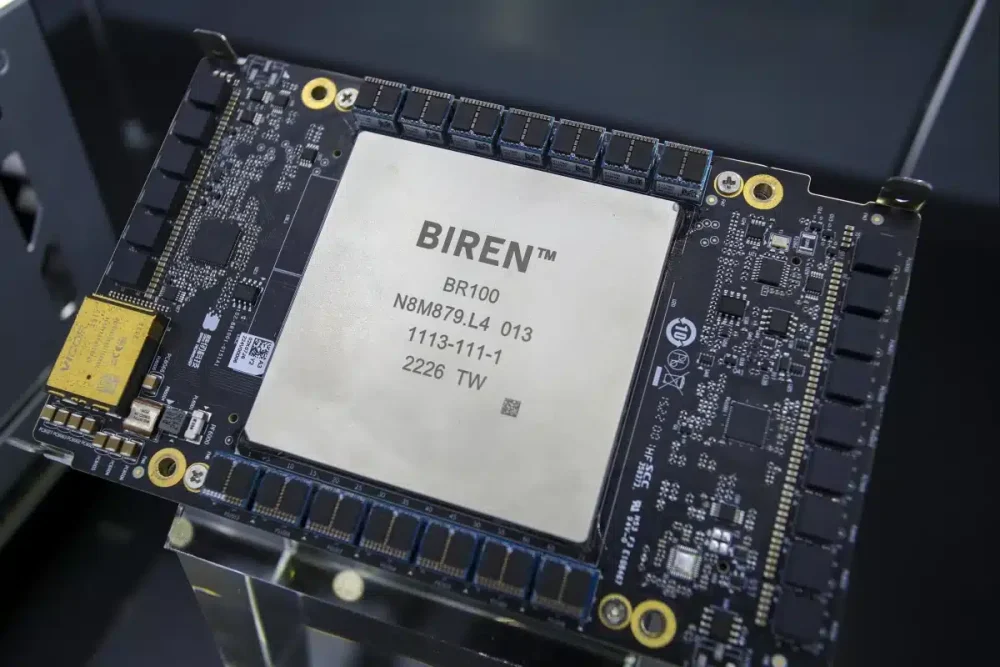

Founded in 2019, Biren focuses on data-center-class AI accelerators and intelligent computing solutions. The company began generating revenue in 2023, reporting 336.8 million yuan (US$47.8 million) in sales last year and additional growth in 2025. It also disclosed 2.1 billion yuan in pending and contracted orders, which it says will support near-term expansion.

Most IPO proceeds will be directed toward research and development and commercialisation, as Biren competes in a fast-moving AI chip market driven by demand from cloud computing, large language models, and domestic AI infrastructure.

Strong Investor Backing, Rising Losses

The IPO has attracted 23 cornerstone investors, committing about US$372.5 million with a six-month lock-up. Backers include Qiming Venture Partners, Ping An Group, UBS, Digital China, and several global asset managers.

Despite revenue growth, Biren remains loss-making. Its losses widened sharply in the first half of 2025 as spending increased on chip design, software, and scaling operations. The company also flagged geopolitical risks, including U.S. trade restrictions, which have limited access to certain foreign technologies since Biren was added to Washington’s blacklist in 2023.

Part of China’s “Four Little Dragons”

Biren’s listing follows explosive debuts by GPU peers Moore Threads and MetaX, whose shares surged after recent listings in Shanghai. Along with Enflame Technology, the companies are often referred to as China’s “four little dragons”, startups seeking to build domestic alternatives to Nvidia’s AI accelerators.

The IPO also fits into a broader wave of Chinese AI firms turning to Hong Kong markets, as investor appetite for AI hardware and infrastructure remains strong.

AI Growth

Biren’s Hong Kong debut highlights how China’s GPU startups are turning to capital markets to fund long, expensive development cycles in AI chips. While profitability remains distant, strong investor interest suggests confidence that demand for domestic AI hardware will continue to grow, even as geopolitical pressures reshape global semiconductor supply chains.