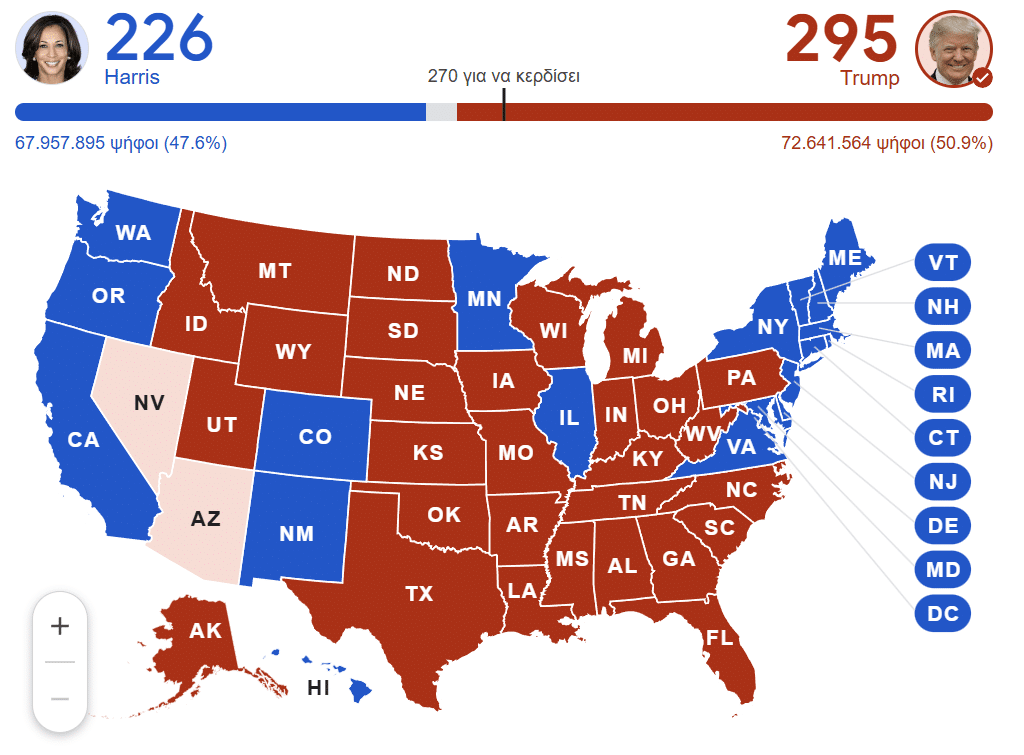

Donald Trump won the US elections and will soon be president again. During his first term in office, his administration imposed tariffs of up to 25% on more than $360 billion in products from China. President Joe Biden’s administration kept most of those tariffs and added more on goods, including Chinese electric cars and microchips. During his campaign, Trump has said he plans to impose a 60% tax on goods from China and a 10% to 20% levy on all of the $3 trillion in foreign goods the U.S. imports annually. This means that you should expect everything to get more expensive, not only in the US market, and I will explain that below.

With a 60% tax on goods from China, most Chinese manufacturers will be forced to move the production to other countries, including Vietnam, India, and Thailand. Many manufacturers have already done so, with Vietnam being among the most popular. However, moving the entire production to another country is not that easy. It is pretty hard, and it also costs a lot. You also have to train the personnel from scratch to keep the production quality high enough, which is pretty hard, especially in countries with limited experience in manufacturing. We had some talks with big PSU manufacturers during our visit to China in November (2024), and they informed us that the cost in countries like Vietnam constantly increases by up to 7% per year, meaning that they also have to sell their products at higher prices to keep up. And guess who will eventually pay for the increased production cost? All of us are consumers.

President-elect Trump might want to increase production on US soil by raising the tariffs on everything that comes from abroad, especially from China. Still, this strategy has had colossal side effects that eventually affect consumers. The only advantage seems to be for the respective economies of the countries where the Chinese manufacturers move their production lines.