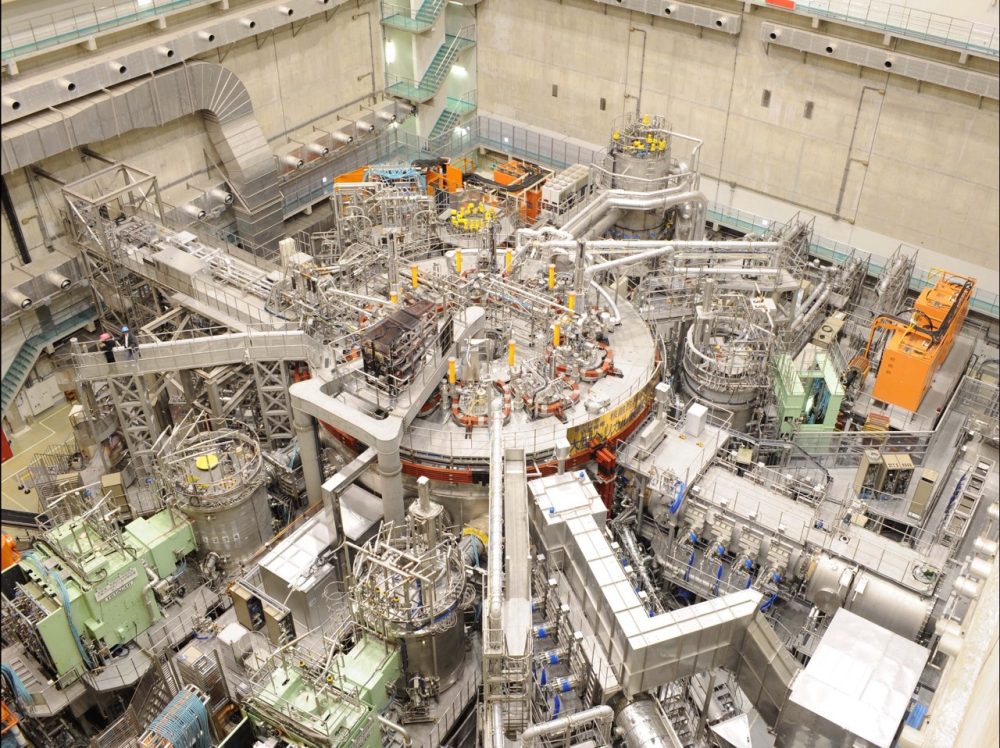

Yangtze Memory Technologies Co. (YMTC), China’s leading NAND flash maker and a central player in the U.S.–China chip war, is moving forward with plans to build a third manufacturing plant in Wuhan. The new fab is expected to start mass production in 2027 and signals Beijing’s determination to secure “memory sovereignty” by ramping up domestic chip capacity, even as YMTC remains cut off from advanced U.S. technology.

Building A Memory Empire Under Pressure

The new Wuhan facility is YMTC’s boldest expansion since the company was added to the U.S. Entity List in December 2022. That move severely restricted its access to advanced lithography systems, precision etching tools, and key U.S.-origin design IP, equipment, and know-how that rivals like Samsung, SK hynix, Kioxia, and Micron rely on to push into ever-denser NAND nodes.

Instead of retreating, YMTC is doubling down. Backed by strong state support and China’s broader industrial policy, the company is retooling its roadmap to make the most of the tools it can still access, while building capacity to serve domestic demand for PCs, smartphones, SSDs, and data centers.

Still In The NAND Game

Unlike Huawei, which had to pivot aggressively toward software, cloud, and automotive after facing similar restrictions, YMTC is still very much in the chip-making business. It continues to produce NAND flash at scale, though with reduced efficiency and limited access to the latest process technologies.

Before sanctions hit, YMTC’s 232-layer Xtacking 3.0 NAND was seen as technically competitive with Micron and Samsung’s products. Maintaining that level of leadership has become difficult without access to cutting-edge EUV and the most advanced DUV lithography gear from foreign suppliers. Still, the company remains an important player, especially inside China’s borders.

The planned third fab in Wuhan is expected to support high-layer 3D NAND production and give YMTC more room to serve domestic OEMs that are under pressure to reduce reliance on foreign memory suppliers. Even without the very latest tools, simply adding more capacity can be strategically valuable in a market where demand for storage continues to grow.

Strategic Bet On “Memory Sovereignty”

For Beijing, YMTC’s expansion is about much more than one company’s survival. Memory chips are a foundational component of everything from consumer gadgets to AI servers. By expanding YMTC’s manufacturing footprint, China aims to reduce its vulnerability to export controls and geopolitical shocks in a critical supply chain segment.

The 2027 production target also aligns with longer-term national goals: building a self-sustaining semiconductor ecosystem that can at least cover domestic needs, even if Chinese firms lag a generation or two behind the global cutting edge.

What It Means For The Global Market

YMTC’s third fab won’t immediately threaten NAND leaders in Korea, Japan, or the U.S., but it reinforces a few key trends:

-

Fragmentation of supply chains – Memory production is increasingly being carved into “trusted” and “local” ecosystems based on politics as much as price.

-

More capacity, different rules – Even if YMTC can’t match top-end specs, extra domestic capacity lets Chinese device makers source more memory locally, reshaping demand patterns over time.

-

Long game strategy – With this investment, YMTC and Beijing are signalling they’re willing to play the long game: accept short-term inefficiencies now in exchange for greater control and resilience later.