The AI gold rush is starting to drain one of the tech industry’s oldest and most reliable resources: the humble hard drive.

New reports reveal that high-capacity HDDs are now on backorder for up to two years, as the world’s largest cloud providers rush to feed the insatiable storage needs of artificial intelligence systems.

According to TrendForce and DigiTimes, demand for nearline enterprise HDDs, the massive drives that power hyperscale data centers, has exploded far beyond manufacturers’ production capacity. Companies such as Google, Microsoft, and Oracle are buying every terabyte they can find to support AI inference workloads, pushing global supply chains to the brink.

AI Inference Creates a Data Avalanche

The AI boom has shifted from training to inference, the phase where large language models and other neural networks actually perform tasks, and that’s where data volumes multiply exponentially.

Unlike static storage for trained models, inference workloads constantly generate, process, and move data across servers. Every AI response, search query, image, or chatbot query generates gigabytes of data that must be stored somewhere.

TrendForce notes that nearline HDDs, long considered the backbone of data center storage, are now facing “severe shortages” due to this unexpected spike in demand.

As a result, lead times for 30TB and 32TB hard drives have stretched from a few weeks to more than 52 weeks, and in some cases, orders placed today might not arrive until late 2026.

That’s not just a minor logistics hiccup; it’s a tectonic shockwave through the data storage market.

Western Digital: Prices Going Up, Shipments Slowing Down

The situation is so extreme that Western Digital has officially raised prices across its entire HDD lineup, citing “unprecedented demand” and a strain on manufacturing capacity.

The company is also increasing its use of ocean freight to move products between regions, which could add 6 to 10 weeks to shipping times for external and enterprise drives.

For consumers and small businesses, that means longer wait times and higher prices, not because of gaming or video editing demand, but because AI models are hogging your hard drive space.

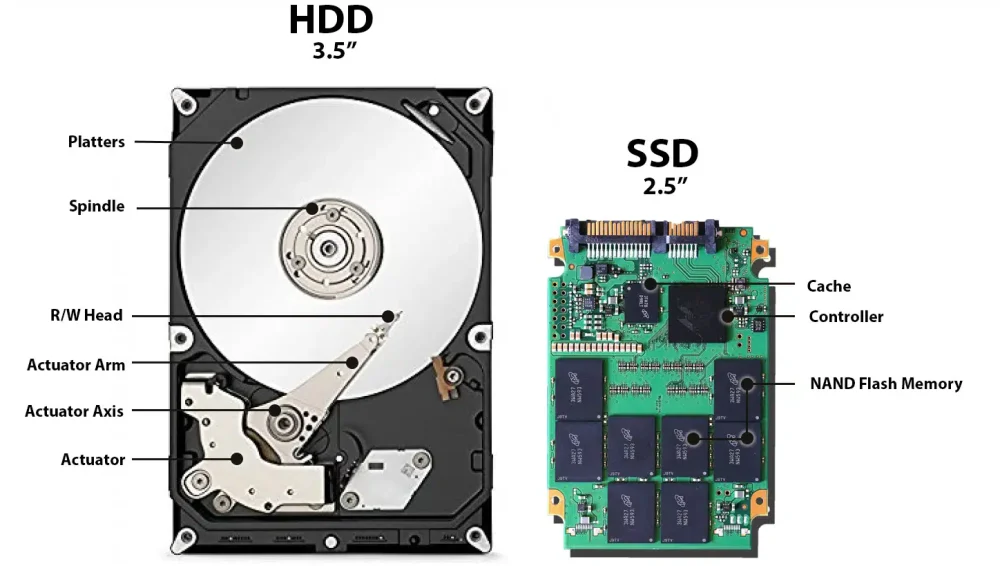

SSD Adoption Accelerates, Even for Cold Data

In a surprising twist, this shortage is forcing a rapid industry pivot to QLC NAND-based SSDs (quad-level cell flash).

While SSDs are faster and more energy efficient than HDDs, they’re also more expensive and typically used for “hot” or “warm” data files that need to be accessed quickly. “Cold” data, on the other hand, usually lives on cheaper hard drives since it’s rarely touched.

But with no HDDs to buy, even cold data storage is being offloaded to SSDs.

That’s a bold and costly move: TrendForce warns that it’s “not financially prudent” to use SSDs for long-term archiving. Still, cloud providers have no choice. They’re now reconfiguring entire systems to handle SSD storage for workloads that traditionally relied on mechanical disks.

And there’s another problem: QLC NAND production is fully booked through 2026, meaning SSD prices could soon follow HDDs upward.

QLC NAND to Overtake TLC by 2027

Industry analysts now predict that QLC NAND will overtake TLC NAND (triple-level cell flash) as the dominant storage technology by early 2027.

The switch isn’t just about performance; it’s about sheer survival. QLC NAND packs more bits per cell, offering larger capacities at lower cost, albeit with slightly reduced endurance. For AI-scale workloads, that’s a tradeoff worth making.

In fact, some NAND producers, like SanDisk, have already raised prices by up to 50%, after initially warning of smaller increases earlier this year.

The ripple effect will likely hit consumer-grade SSDs next, especially since mainstream drives often use the same QLC supply chain as enterprise models.

The AI Effect: When Machines Outpace Manufacturing

This is the latest example of AI outpacing the physical world’s ability to keep up.

Factories that make HDDs, NAND chips, and DRAM modules were never designed for the blistering scale of modern AI data centers, facilities that can consume hundreds of petabytes of storage each month.

Just as the world witnessed a memory crunch earlier this year, with DRAM prices doubling due to AI-driven demand, the same story is now unfolding in storage.

In the words of one industry insider: “AI money doesn’t wait for anyone.”

Manufacturers are now prioritizing hyperscalers, clients willing to pay premium prices, over smaller enterprise buyers and consumers. This has left ordinary users, small firms, and even national labs waiting months for standard storage gear.

A Two-Year Wait for 32TB Drives

At the moment, 30TB Seagate Exos Mozaic+ drives are still available for enterprise clients, but anything larger is practically impossible to find.

Drives in the 32TB to 36TB range, critical for cloud-scale storage, are now on two-year backorder lists.

Even companies that rely on long-term archiving, such as video streaming services or research institutions, are being told to expect delivery dates stretching into 2027.

For data centers planning extensive upgrades, that’s a serious operational nightmare.

SSD Prices Expected to Rise 5–10% in Q4 2025

TrendForce anticipates that enterprise SSD contract prices will rise between 5% and 10% in Q4 2025, as hyperscalers rush to lock in capacity before NAND inventories tighten further.

Given that all DRAM and NAND makers are now selling nearly everything they can produce to AI clients, the typical 2–3 month buffer in supply chains has collapsed to just a few weeks.

And that scarcity doesn’t just hit the data center giants, it trickles down to regular consumers, driving up the cost of gaming SSDs, NAS drives, and even external storage.

AI Eats the Storage World

What’s happening now may mark the start of a new era in storage economics, one where AI infrastructure dictates the pace of manufacturing, not consumer demand.

Hard drives, once taken for granted, are now precious commodities in the race to power smarter machines.

By 2026, expect AI training and inference farms to account for the majority of global HDD and SSD shipments. Analysts suggest that the shortage could continue until 2027, when new fabrication plants and expanded HDD assembly lines finally come online.

Until then, both consumers and corporations may have to adapt to longer waits, higher costs, and shifting technologies.