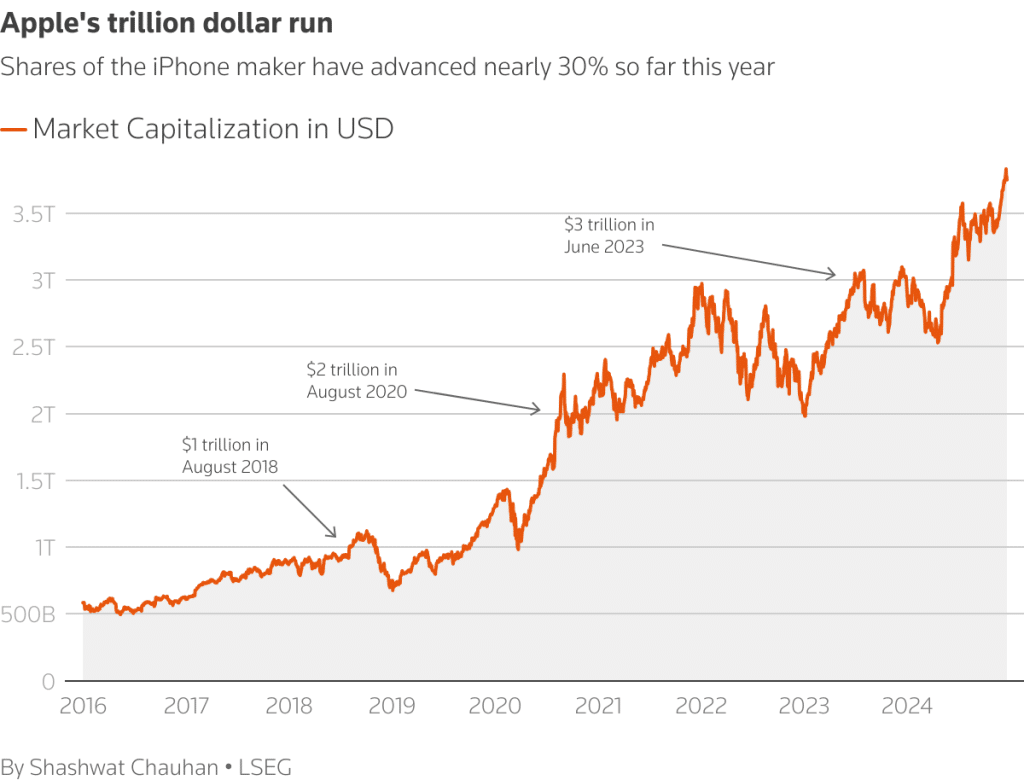

Apple Inc. is on the brink of a monumental achievement, potentially becoming the first company in history to reach a $4 trillion market capitalization by early 2025. Recent surges in the company’s stock value, driven by investor excitement over advancements in artificial intelligence (AI), have positioned the tech giant for this historic milestone.

AI Momentum Boosts Apple’s Valuation

Since early November, Apple’s shares have soared by approximately 16%, adding $500 billion to its market cap and an impressive $3.85 trillion as of the last trading session. Analysts attribute this growth to expectations surrounding the company’s AI advancements, which are anticipated to rejuvenate iPhone sales and trigger a new supercycle of upgrades.

Tom Forte, an analyst at Maxim Group, noted that this rally reflects “investor enthusiasm for artificial intelligence and an expectation that it will result in a supercycle of iPhone upgrades.”

The Road to AI Integration

Apple has faced criticism in recent years for its perceived slow adoption of AI compared to competitors like Microsoft, Alphabet, and Nvidia. However, the company’s new AI feature, Apple Intelligence, is expected to drive demand for the upcoming iPhone 16 series during the 2024 holiday season. Analysts at Wedbush Securities believe Apple could sell over 240 million iPhones in its 2025 fiscal year, marking the highest annual iPhone sales in the company’s history.

Capitalizing on a Vast User Base

Apple’s installed base of 2 billion iOS devices, including 1.5 billion iPhones, provides a substantial opportunity for growth. Wedbush says approximately 300 million current iPhones have not been upgraded within the past four years. This and the company’s strong services business and AI integration could propel Apple toward unprecedented financial success.

Revenue and Valuation Trends

While Apple’s annual revenue grew by just 1% in fiscal 2024, iPhone sales in the September quarter rose 6% year-over-year to $46.22 billion. The company expects overall revenue to grow by “low- to mid-single digits” during the fiscal first quarter of 2025, aligning with the holiday shopping season. Despite these modest forecasts, analysts anticipate a rebound in iPhone revenue by 2025, bolstered by adopting AI-driven features.

The recent surge in Apple’s shares has pushed its price-to-earnings ratio to a three-year high of 33.5, surpassing those of Microsoft (31.3) and Nvidia (31.7). While some investors, including Warren Buffett’s Berkshire Hathaway, have reduced their holdings due to valuation concerns, others remain optimistic about Apple’s long-term growth.

Challenges on the Horizon

Apple’s path to a $4 trillion valuation is not without challenges. The company faces potential retaliatory tariffs if U.S. trade policies with China tighten under the incoming administration. However, analysts believe that Apple’s key products, such as the iPhone, Mac, and iPad, may receive exemptions, as was the case during the 2018 tariff round.

The Broader Market Context

Apple’s journey toward a $4 trillion market cap underscores its resilience and dominance in the tech sector. As global markets navigate monetary policy shifts and geopolitical uncertainties, technology stocks like Apple are increasingly viewed as defensive investments due to their consistent earnings growth.

Adam Sarhan, CEO of 50 Park Investments, summarized Apple’s achievement: “Apple’s approach to a $4 trillion market cap is a testament to its enduring dominance in the tech sector. This milestone reinforces Apple’s position as a market leader and innovator.”

Looking Ahead

With its robust ecosystem, strategic AI rollout, and massive user base, Apple is poised to solidify its position as the most valuable company in the world. If the company’s AI-driven initiatives and iPhone supercycles meet expectations, the $4 trillion milestone could arrive sooner rather than later, marking another chapter in Apple’s storied innovation and market leadership history.